Here is a detailed review of NordFX presented by Dailyforex.com

Key Features:

- Raw spreads starting from 0.0 pips

- Proprietary copy trading platform

- PAMM accounts for portfolio management

- VPS hosting tailored for algorithmic traders

- Limited selection of trading instruments

Average Trading Cost (EUR/USD): 1.2 pips

Minimum Deposit: $10

NordFX Verdict

NordFX, a broker operating from Saint Lucia, offers traders competitive raw spreads starting from 0.0 pips and leverage up to 1:1000. The platform boasts a proprietary copy trading system, alongside PAMM accounts and crypto-staking services that can yield annual returns of up to 30%. With a focus on fast order execution, NordFX aims to meet the needs of both scalpers and long-term portfolio managers.

This review assesses whether NordFX reputation for low costs and efficient trading justifies its accolades. Is it the right broker for your trading or investment needs?

Ratings

- Overall Rating: 4/5

- Fees: 4/5

- Deposit and Withdrawal Process: 5/5

- Asset Selection: 4/5

- Ease of Account Opening: 5/5

- Regulation and Security: 5/5

Overview

Below you’ll find a detailed review of NordFX.

Broker Type:

An ECN broker prioritizing asset management and high-leverage trading.

- Headquarters: Saint Lucia

- Regulators: Saint Lucia

- Owned by Public Company: No

- Established: 2008

- Minimum Deposit: $10

- Trading Platforms: MetaTrader 4 and MetaTrader 5

Average Trading Costs:

- EUR/USD: 1.2 pips

- GBP/USD: 1.9 pips

- WTI Crude Oil: $0.03

- Gold: $0.24

Other Features:

- Islamic Accounts: Available

- Trading Signals: Yes

- US Persons Accepted: No

- Managed Accounts: Yes

Highlights

NordFX stands out for its proprietary copy trading platform, traditional PAMM account services, and the management of five investment funds. It provides extensive analytics, trading signals, and an engaging affiliate program. Traders benefit from 24/5 customer support, tight spreads, and quick execution, while new traders can take advantage of its educational resources.

Whether you are a scalper, a day trader, or a long-term investor, NordFX offers a flexible platform with tailored tools to meet diverse trading preferences.

NordFX Main Features Table

| Feature | Details |

| Retail Loss Rate | Undisclosed |

| Regulation | Yes |

| Minimum Raw Spreads | 0.0 pips |

| Minimum Standard Spreads | 0.9 pips |

| Minimum Commission for Forex | 0.0035% (one side), 0.007% (both sides) |

| Commission for CFDs/DMA | 0.10% – 0.20% |

| Commission Rebates | No |

| Minimum Deposit | $10 |

| Demo Account | Yes |

| Managed Account | Yes |

| Islamic Account | Yes |

| Inactivity Fee | $20 annually after 12 months |

| Deposit Fee | No |

| Withdrawal Fee | Third-party charges |

| Funding Methods | 9 |

This table summarizes NordFX core features, emphasizing its low trading costs, accessible minimum deposit, and additional services like Islamic and managed accounts.

NordFX Fees Table

| Fee Type | Details |

| Average Trading Cost (EUR/USD) | 1.2 pips |

| Average Trading Cost (GBP/USD) | 1.9 pips |

| Average Trading Cost (WTI Crude Oil) | $0.03 |

| Average Trading Cost (Gold) | $0.24 |

| Average Trading Cost (Bitcoin) | $328 |

Forex Account Types and Costs

| Account Type | Minimum Spread (EUR/USD) | Commission per Round Lot | Cost per 1.0 Standard Lot |

| Commission-Free Account | 0.9 pips | $0.00 | $9.00 |

| Commission-Based Account (Minimum Spread) | 0.0 pips | $7.00 | $7.00 |

| Commission-Based Account (Average Spread) | 0.3 pips | $7.00 | $10.00 |

CFDs

| Instrument | Trading Fee |

| Index CFDs | 0.05% per round trip |

| Equity CFDs | 0.20% per round trip |

Traders can choose between a commission-free Forex account with spreads starting at 0.9 pips or a more competitive commission-based account with raw spreads from 0.0 pips and a commission of $7.00 per round lot. While the average spread increases the cost slightly to $10.00 per lot, the structure remains competitive compared to industry standards. For CFDs, index fees are 0.05% per round trip, while equity CFDs cost 0.20%, aligning with common market rates.

NordFX MT4 Trading Platform and Costs

Key Highlights:

- Positive Swap Rates: NordFX offers positive swap rates on EUR/USD short positions, meaning traders may earn money instead of incurring fees.

- Transparency: All trading conditions and times are clearly displayed on the website and the MT4 platform.

- Inactivity Fee: A $20 annual fee applies after 12 months of inactivity, but active traders won’t encounter this cost.

Overnight Trading Costs

- Overnight Costs for 1 Night

| Spread Type | Spread (Tightest/AVG) | Commission (Round Lot) | Swap (Long) | Swap (Short) | Total Trading Costs |

| Buy Position | 0.0 pips / 0.3 pips | $7.00 | -$8.00 | N/A | $15.00 / $18.00 |

| Sell Position | 0.0 pips / 0.3 pips | $7.00 | N/A | $3.80 | $3.20 / $6.20 |

- Overnight Costs for 7 Nights

| Spread Type | Spread (Tightest/AVG) | Commission (Round Lot) | Swap (Long) | Swap (Short) | Total Trading Costs |

| Buy Position | 0.0 pips / 0.3 pips | $7.00 | -$56.00 | N/A | $63.00 / $66.00 |

| Sell Position | 0.0 pips / 0.3 pips | $7.00 | N/A | $26.60 | -$19.60 / -$16.60 |

Observations

- Positive Swap Advantage:

Traders benefit from receiving positive swap rates where applicable, reinforcing a trading environment free from manipulation. - Swap Awareness:

Overnight fees can become a significant component of total costs depending on the trading strategy. It’s crucial to review swap rates before calculating overall expenses. - MT4 Features:

The MT4 platform provides clear visibility of trading conditions and timings, ensuring a seamless trading experience.

NordFX combines competitive costs with transparent practices, making it suitable for traders seeking tight spreads, low commissions, and a reliable trading environment. While swap rates can be a significant expense, NordFX positive swap offerings on certain positions provide a noteworthy advantage.

NordFX offers the MetaTrader 5 (MT5) platform, an advanced trading terminal that supports a wide range of financial instruments, including Forex, stocks, precious metals, and cryptocurrencies.

Key Features of NordFX MT5:

- Advanced Technical Analysis: MT5 is equipped with an extensive array of built-in technical indicators and graphical tools, facilitating comprehensive market analysis.

- Automated Trading: The platform supports Expert Advisors (EAs), allowing for automated trading strategies that can operate continuously without manual intervention.

- Integrated Economic Calendar: Traders have access to an economic calendar within MT5, providing timely updates on key economic events and indicators.

- Depth of Market (DOM): This feature offers insights into market liquidity, enabling traders to make informed decisions based on real-time data.

- Advanced Strategy Tester: MT5 includes a sophisticated strategy tester for back-testing EAs with real tick data, enhancing the development and optimization of trading strategies.

Swap Rates on MT5:

Swap rates, or overnight financing charges, are applied to positions held open overnight. These rates can be either positive or negative, depending on the interest rate differential between the currencies involved in a trade. NordFX calculates swaps as the difference between interest rates, and they are charged daily at 00:00 server time. From Wednesday to Thursday, swaps are charged at a triple rate to account for the weekend.

Calculation of Swap Rates:

The swap rate is determined by the formula:

Swap Rate = Pip Value × Number of Lots × Number of Days

It’s important to note that swap rates can be both positive and negative, depending on the interest rate differential between the two currencies in a pair. Traders should be aware of these rates, as they can significantly impact the profitability of long-term positions.

Transparency and Information Access:

NordFX ensures that all information regarding trading conditions, including swap rates and trading times, is readily available on their website and within the MT5 platform. This transparency allows traders to make informed decisions and effectively manage their trading costs.

Inactivity Fee:

A $20 annual inactivity fee is applied after twelve months of account dormancy. Active traders who regularly engage in trading activities will not incur this fee.

The MetaTrader 5 platform offered by NordFX provides traders with a comprehensive suite of tools and features designed to enhance the trading experience. With advanced technical analysis capabilities, support for automated trading, and transparent information on trading conditions, MT5 caters to both novice and experienced traders. However, it’s crucial for traders to be mindful of swap rates and other potential costs associated with overnight positions to manage their trading expenses effectively.

NordFX offers a diverse selection of trading instruments across multiple asset classes, catering to various trading strategies and preferences. Below is an overview of the available assets and their corresponding leverage options:

Available Trading Instruments:

- Forex: 33 currency pairs, including major, minor, and exotic pairs.

- Cryptocurrencies: 13 cryptocurrency pairs, featuring popular digital assets.

- Commodities: 5 commodities, encompassing precious metals like gold and silver, as well as crude oil.

- Indices: 4 index CFDs, allowing traders to speculate on major stock indices.

- Equities: 23 equity CFDs, providing exposure to leading global companies.

Asset List and Leverage Overview:

| Asset Class | Available | Maximum Leverage |

| Currencies | Yes | Up to 1:1000 |

| Commodities | Yes | Up to 1:1000 |

| Crude Oil | Yes | Up to 1:1000 |

| Gold | Yes | Up to 1:1000 |

| Metals | Yes | Up to 1:1000 |

| Equity Indices | Yes | Up to 1:1000 |

| Stocks (CFDs) | Yes | Up to 1:1000 |

| Crypto | Yes | Up to 1:1000 |

| Stocks (non-CFDs) | No | N/A |

| ETFs | No | N/A |

| Futures | No | N/A |

| Synthetics | No | N/A |

Note: The maximum leverage of up to 1:1000 is available across various asset classes; however, specific leverage limits may apply based on the instrument and account type to ensure responsible trading practices and effective risk management.

NordFX trading environment is particularly advantageous for scalpers and high-frequency traders who prioritize liquid assets with tight spreads. The broker’s infrastructure supports rapid order execution, which is essential for these trading strategies.

For a comprehensive and up-to-date list of available instruments and their specific leverage ratios, traders should consult NordFX official resources or contact their customer support not NordFX reviews.

NordFX provides traders with substantial leverage options, offering up to 1:1000 across various account types and instruments. This high leverage enables traders to control larger positions with a relatively small capital outlay, potentially amplifying profits. However, it’s crucial to implement rigorous risk management strategies to mitigate the increased risk associated with higher leverage. Notably, NordFX offers negative balance protection, ensuring that traders cannot lose more than their account balance, which is essential for leveraged trading.

Trading Hours (GMT+2):

| Asset Class | Opening Time | Closing Time |

| Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

| Forex | Monday 00:00 | Friday 24:00 |

| Commodities | Monday 00:00 | Friday 23:00 |

| European CFDs | Monday 09:00 | Friday 17:30 |

| US CFDs | Monday 15:30 | Friday 22:00 |

Note: Equity markets have specific opening and closing times each trading day and do not operate continuously like Forex and cryptocurrency markets.

Accessing Trading Hours in MT4:

- Right-Click on Symbol: In the Market Watch window, right-click on the desired symbol and select “Specification.”

- View Sessions: Scroll down to the “Sessions” section to view the trading hours for the selected instrument.

This method allows traders to easily access and verify the trading hours for specific instruments directly within the MT4 platform.

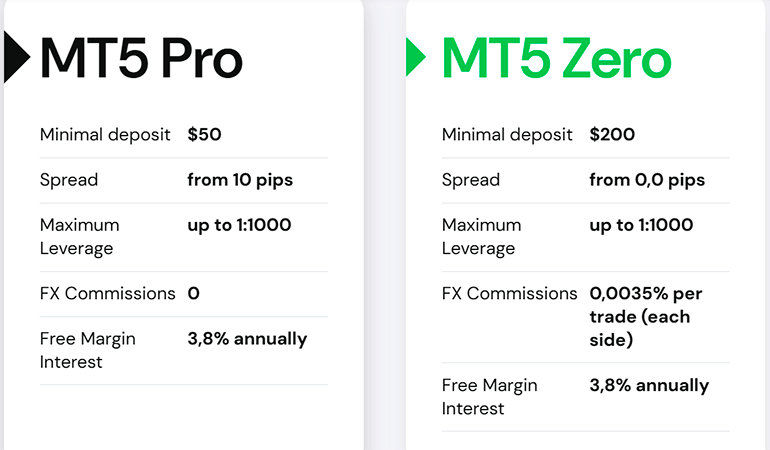

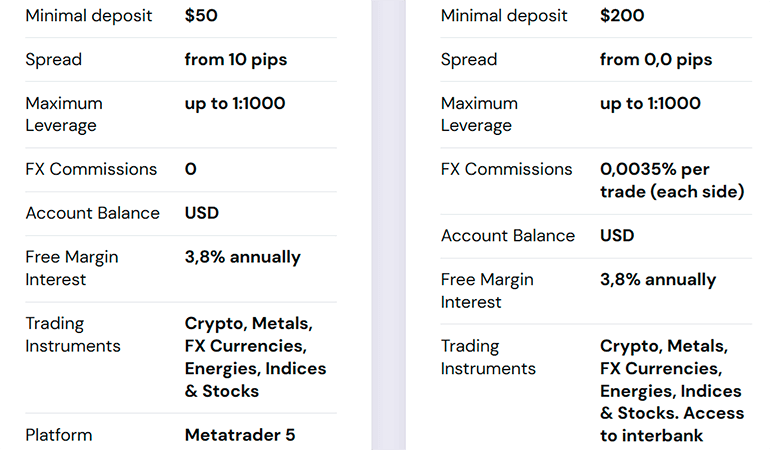

NordFX provides a range of account types tailored to accommodate various trading preferences and experience levels. Below is an overview of the available accounts:

| Account Type | Minimum Deposit | Spread | Leverage | Commission | Trading Instruments | Platform |

| MT5 Pro | $50 | From 10 pips | Up to 1:1000 | None | Forex, Cryptocurrencies, Metals, Energies, Indices, Stocks | MetaTrader 5 |

| MT5 Zero | $200 | From 0.0 pips | Up to 1:1000 | 0.0035% per trade (each side) | Forex, Cryptocurrencies, Metals, Energies, Indices, Stocks | MetaTrader 5 |

| MT4 Pro | $10 | From 10 pips | Up to 1:1000 | None | Forex, Cryptocurrencies, Metals, Energies, Indices, Stocks | MetaTrader 4 |

| MT4 Zero | $100 | From 0.0 pips | Up to 1:1000 | 0.0035% per trade (each side) | Forex, Cryptocurrencies, Metals, Energies, Indices, Stocks | MetaTrader 4 |

Key Features:

- MT5 Pro: Designed for both beginners and experienced traders, offering a wide range of instruments with competitive spreads and no commissions.

- MT5 Zero: Provides access to interbank liquidity with raw spreads starting from 0.0 pips, suitable for traders seeking the tightest spreads.

- MT4 Pro: Offers a broad selection of trading instruments with low dynamic spreads and fast market execution.

- MT4 Zero: Ideal for traders who prefer the MetaTrader 4 platform with access to zero spreads and ECN liquidity.

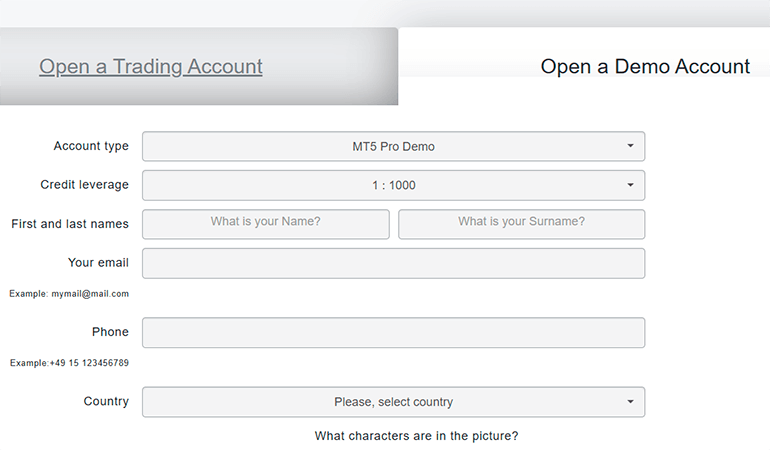

Demo Accounts:

NordFX offers demo accounts for all account types, allowing traders to practice and refine their strategies in a risk-free environment. These accounts mirror real market conditions, providing valuable experience without financial risk.

Islamic (Swap-Free) Accounts:

Swap-free accounts are available for clients with Islamic religious beliefs, ensuring compliance with Sharia law by waiving rollover fees. To obtain a swap-free account, clients must provide sufficient proof of their religion. Please note that certain symbols may incur a small storage fee after a specified period.

For detailed information on each account type and to choose the one that best fits your trading needs, please visit NordFX’s official Accounts page.

NordFX offers traders access to two of the most renowned trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are available across multiple devices, including desktop, web, and mobile applications, ensuring flexibility and convenience for traders.

Overview of Trading Platforms:

| Platform | Availability | Automated Trading | Depth of Market (DOM) | Guaranteed Stop Loss | Scalping | Hedging | One-Click Trading | OCO Orders | Interest on Margin |

| MT4 | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

MetaTrader 4 (MT4):

MT4 is celebrated for its user-friendly interface and robust functionalities, making it a preferred choice for traders worldwide. It supports automated trading through Expert Advisors (EAs) and offers advanced charting tools, technical analysis capabilities, and a comprehensive suite of indicators. Traders can access MT4 via desktop applications, web browsers, and mobile devices, ensuring seamless trading experiences across platforms.

MetaTrader 5 (MT5):

As the successor to MT4, MT5 provides enhanced features, including additional timeframes, more technical indicators, and an integrated economic calendar. It supports a broader range of trading instruments, such as Forex, cryptocurrencies, stocks, and commodities. MT5 also facilitates automated trading and offers an advanced strategy tester for back-testing trading algorithms. Like MT4, MT5 is accessible via desktop, web, and mobile platforms.

Additional Features:

- Automated Trading: Both MT4 and MT5 support automated trading through EAs, allowing traders to implement algorithmic strategies.

- Depth of Market (DOM): Available on both platforms, providing insights into market liquidity and order flows.

- Guaranteed Stop Loss: Traders can set guaranteed stop-loss orders to manage risk effectively.

- Scalping and Hedging: Both strategies are permitted, offering flexibility in trading approaches.

- One-Click Trading and OCO Orders: Facilitate swift trade executions and advanced order management.

- Interest on Margin: NordFX offers interest on free margin, enhancing potential returns for traders.

By providing both MT4 and MT5 platforms, NordFX caters to a wide spectrum of trading styles and preferences, ensuring that traders have access to the tools and features necessary for effective trading.

Unique Features of NordFX

Copy Trading Platform:

NordFX offers a proprietary, user-friendly copy trading platform, providing all necessary data to make informed investments. It simplifies trading for beginners and allows experienced traders to showcase and monetize their strategies.

PAMM Services:

NordFX includes PAMM accounts for retail portfolio management, catering to traders who prefer a hands-off approach.

VPS Hosting:

NordFX supports algorithmic trading with VPS hosting provided by Fozzy at a cost of $13.95 per month. While a free VPS would be beneficial for active traders, the service ensures seamless trading for high-frequency and automated strategies.

Research and Education

- Research:

Weekly market reviews are insightful but could benefit from daily updates. Instead of extensive in-house research, NordFX focuses on asset management tools like PAMM accounts, investment funds, and embedded MT4 signal services. - Education:

- The Learning Center provides short, third-party video tutorials covering essential trading topics for beginners.

- Over a dozen well-written articles cater to new traders seeking foundational knowledge.

Customer Support

- Support Channels:

Email, live chat, web form, and phone support are available. - Languages:

English, Spanish, Arabic, Chinese, Russian, Portuguese, Malay, Thai, and Indonesian. - Availability:

Multilingual support is available 24/5.

NordFX customer support is efficient and easy to access, ensuring traders can resolve issues swiftly.

Bonuses and Promotions

At the time of review, NordFX hosted a $100,000 lottery for Pro account holders. Winnings are withdrawable without restrictions, but terms and conditions apply. Promotions are limited to specific account types, with Pro accounts being the primary focus.

Account Registration

Opening an account with NordFX is straightforward:

- Provide your name, email, phone number, and country.

- Select an account type, leverage, and base currency.

- Complete verification by uploading proof of ID and residency.

Social media accounts (Google, Facebook, Twitter) can also be used for quick registration.

Payment Methods

- Options:

Bank wires, credit/debit cards, WebMoney, Skrill, Neteller, Perfect Money, Ngan Luong, PayToday, and Dragonpay. - Deposits:

No deposit fees. - Withdrawals:

No NordFX fees, but third-party fees may apply. Profits can be withdrawn using any available method, adding flexibility.

Accepted Countries

NordFX serves clients globally, excluding residents of the US, Canada, EU, Russia, Cuba, Sudan, and Syria.

Summary

NordFX is an excellent choice for scalpers, high-frequency traders, and investors interested in asset management. While the research offerings are minimal and the asset selection somewhat limited, the broker compensates with competitive trading costs, a robust copy trading platform, PAMM accounts, and reliable customer support.

The Zero Account stands out for its tight spreads, high leverage, and attractive commission structure. The broker continually evolves, making it a strong candidate for both new and experienced traders seeking a dependable trading partner.

FAQ for NordFX Review

- Is NordFX a reliable broker?

Yes, NordFX is a reliable broker with over 1,700,000 accounts across 190+ countries. It is regulated and offers robust trading platforms like MT4 and MT5, as well as competitive account features. - What is the minimum deposit required to start trading with NordFX?

The minimum deposit depends on the account type:

- Fix Account: $10

- Pro Account: $250

- Zero Account: $500

- DeFi Savings Account: $500

- Does NordFX offer a demo account?

Yes, NordFX provides a demo account for all traders to practice their strategies risk-free. It simulates real-market conditions and is ideal for beginners and strategy testing. - What trading platforms does NordFX support?

NordFX supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which are available on desktop, mobile, and web versions. - What payment methods are available for deposits and withdrawals?

NordFX accepts multiple payment methods, including bank transfers, credit/debit cards, Skrill, Neteller, WebMoney, Perfect Money, Ngan Luong, PayToday, and Dragonpay. - Does NordFX offer copy trading or managed accounts?

Yes, NordFX provides a proprietary copy trading platform and PAMM accounts for traders interested in portfolio management and automated trading strategies. - What is the maximum leverage offered by NordFX?

NordFX offers leverage up to 1:1000, depending on the account type and trading instrument, making it suitable for both beginners and experienced traders.

Wow since 2008! Long history! Should definetly try this broker.

Trading is always risky, I prefer to buy crypto and keep it)).