Successful Forex trading doesn’t require dozens of indicators or complex algorithms. In practice, many consistently profitable traders rely on a few simple, well-structured strategies that align with market behavior.

In this guide, we’ll focus on three straightforward yet effective Forex strategies built around trend direction, momentum confirmation, and position management.

Strategy 1 — RSI & EMA Momentum Crossover System (High Win Ratio Setup)

Timeframes

H1 and H4 (ideal for swing and intraday traders)

Indicators Used

-

EMA 5 (close)

-

EMA 12 (close)

-

RSI 21

-

CCI 80

Long Entry Rules

Enter a BUY when:

• EMA 5 crosses above EMA 12

• RSI (21) is above 50 and bullish

• CCI (80) is above 50 and bullish

Momentum + trend must agree.

Short Entry Rules

Enter a SELL when:

• EMA 5 crosses below EMA 12

• RSI (21) is below 50 and bearish

• CCI (80) is below 50 and bearish

Stop Loss & Take Profit

Stop loss typically:

-

35–60 pips depending on volatility

-

Lower for calmer pairs (EUR/USD)

-

Higher for volatile pairs (GBP pairs)

Take profit:

-

Based on structure or fixed risk-reward (1:1.5 or 1:2)

Exit Rules

For BUY:

-

EMA 5 crosses back below EMA 12

-

OR RSI & CCI drop below 50

For SELL:

-

EMA 5 crosses back above EMA 12

-

OR RSI & CCI rise above 50

Why It Works

This strategy only enters when:

✔ Trend direction shifts

✔ Momentum confirms

✔ Weak signals are filtered out

It keeps you trading strong moves — not noise. Also needs a minimum deposit.

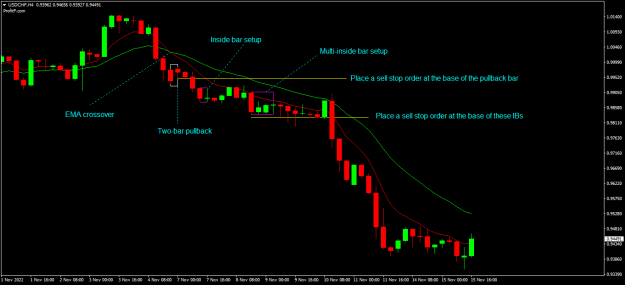

Strategy 2 — EMA Pullback Trend Continuation System (8/21 EMA)

This is a classic professional trend-trading approach — simple, visual, and extremely effective.

Indicators

-

EMA 8

-

EMA 21

(Exact numbers aren’t magic — the logic is what matters.)

Core Concept

-

Wait for EMA 8 to cross EMA 21 → trend forms

-

Do NOT chase price

-

Wait for a pullback toward the EMAs

-

Enter when price resumes trend direction

Entry Examples

BUY:

-

EMAs crossed upward

-

Price pulls back near EMAs

-

Bullish candle forms → enter long

SELL:

-

EMAs crossed downward

-

Price retraces toward EMAs

-

Bearish candle forms → enter short

Best Pullback Patterns

• Two-bar retracement

• Inside bars

• Small consolidation near EMAs

These represent temporary pauses — not reversals.

Stop Loss

-

Below pullback low (for buys)

-

Above pullback high (for sells)

Why It Works

Markets trend, pause, then continue.

This strategy:

✔ Trades with institutions

✔ Avoids emotional chasing

✔ Offers excellent risk-reward

Strategy 3 — Set & Forget Dollar Cost Averaging (Position Building System)

This is a longer-term position strategy focused on averaging price and capturing corrections.

⚠ Requires strict capital management.

How It Works

-

Choose a direction (technical, fundamental, or bias)

-

Open 1 position

-

No stop loss

-

50 pip take profit

-

-

If TP hits → restart process

-

If trade stays open next day:

-

Add another equal position

-

Move TP for all trades to 50 pips from average price

-

-

Repeat until price corrects and TP is hit

Why It Can Be Profitable

Even if price moves against you initially:

• Average entry improves

• Small retracements close the basket in profit

Markets rarely move in straight lines.

Critical Risk Notes

✔ Must have enough margin

✔ Use moderate leverage

✔ Limit total open positions (e.g., 15–20 max)

Without discipline, this becomes dangerous.

With discipline, it can be very consistent.

Final Thoughts

You don’t need complicated systems to succeed in Forex.

These three strategies cover:

✔ Momentum breakouts

✔ Trend continuation

✔ Market corrections

The key is not jumping between methods — but mastering one.

Best approach for most traders:

• Pick ONE strategy

• Backtest it

• Trade it consistently

• Manage risk strictly

That’s how real profitability is built.

Practice on Demo Account first!