In this NordFX account types review, we explore the range of account options NordFX offers, each tailored to suit different trading needs and goals. As a well-established, multi-asset broker, NordFX has built a reputation for providing traders—whether new or experienced—with advanced tools, competitive pricing, and access to diverse assets like forex, cryptocurrencies, and CFDs. With years of expertise, NordFX understands that every trader has unique strategies and preferences, so they’ve crafted accounts with varying spreads, leverage, and commission structures to support a truly personalized trading experience aimed at maximizing investment potential.

Table of Contents

Exploring the Different NordFX Account Types

An Overview of NordFX Account Types

Detailed Breakdown of Each Account Type

Choosing the Right NordFX Account

Tailoring Your Account Choice to Your Strategy

Frequently Asked Questions (FAQ)

Summing Up the NordFX Account Types

Exploring the Different NordFX Account Types

NordFX offers four distinct account types—MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero—each catering to different levels of trading experience and investment objectives. The MT5 Pro and MT5 Zero accounts are designed for traders who prefer the advanced functionalities of the MetaTrader 5 platform, which includes expanded asset classes and more sophisticated analysis tools. On the other hand, the MT4 Pro and MT4 Zero accounts are based on the popular MetaTrader 4 platform, which continues to be a top choice for traders due to its simplicity, reliability, and compatibility with various automated trading strategies.

Each account type varies in terms of spreads, commissions, leverage, and trading instruments, allowing traders to find the one that best suits their approach. For instance, accounts like the MT5 Zero provide access to interbank liquidity with minimal spreads, ideal for professional or high-frequency traders. Conversely, accounts like the MT4 Pro offer more relaxed conditions, making them suitable for traders who might prioritize simplicity over razor-thin spreads.

Tailored Solutions for Every Trader

Whether you’re a professional trader aiming to execute high-volume trades or a beginner taking your first steps in the trading world, NordFX account types ensure you’re not limited by a one-size-fits-all approach. Instead, NordFX diverse account options allow clients to find the right balance between cost-efficiency and flexibility, ensuring they have the tools to pursue their trading goals confidently. This approach to account customization highlights why many traders choose NordFX as their preferred broker.

Ultimately, the choice of account type boils down to a trader’s priorities—some might be focused on reducing trading costs through ultra-low spreads, while others may value having access to a broad range of assets with user-friendly tools. Whatever the preference, NordFX commitment to providing suitable account types empowers traders to tailor their trading conditions, optimizing their chances of success. In the sections that follow, we will delve into each NordFX account type in greater detail, breaking down the specific benefits and unique features that set them apart.

This NordFX account types review will guide you through the essential details to consider, ensuring you choose an account that aligns perfectly with your trading ambitions and preferences.

An Overview of NordFX Account Types

In this NordFX account types review, we’ll break down the four main account options NordFX offers: MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero. Each of these account types is designed to accommodate various trading styles and levels of experience, whether you’re a beginner or a seasoned trader. This diversity of account choices provides NordFX clients with the flexibility to select an account that best aligns with their trading strategies, asset preferences, and risk tolerance.

Here’s a quick look at what each NordFX account type offers:

MT5 Pro Account

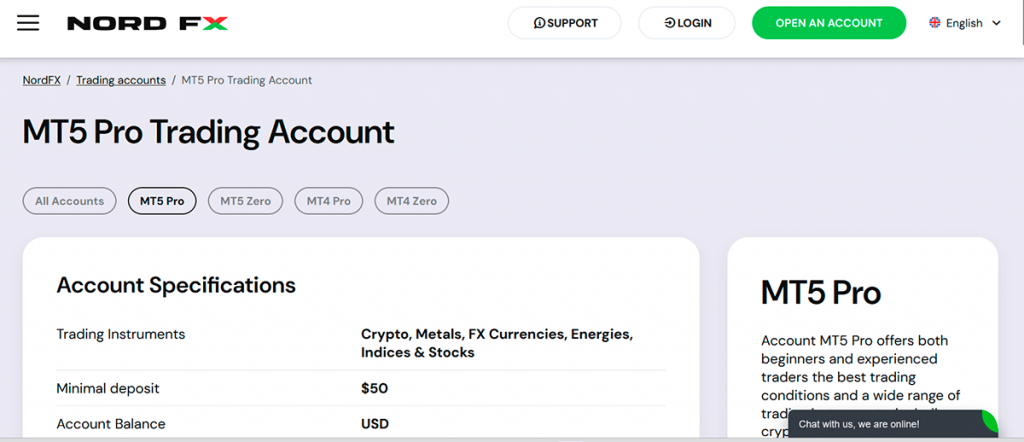

The MT5 Pro account is ideal for traders looking for a high-performance environment with access to the advanced features of MetaTrader 5 (MT5). MT5 is a next-generation trading platform known for its expanded asset classes, multi-threaded back-testing capabilities, and more detailed market analysis tools. With the MT5 Pro account, users can trade forex, CFDs on stocks, commodities, indices, and cryptocurrencies, allowing for extensive portfolio diversification within a single account.

Key highlights of the MT5 Pro account:

- Minimum Deposit: Moderate, making it accessible to many traders while still catering to professionals.

- Spread: Competitive floating spreads, ensuring cost-effective trading.

- Leverage: Up to 1:1000, allowing traders to maximize their trading potential with minimal initial capital.

- Commission: Zero commission on FX pairs, which is beneficial for those who trade frequently and seek to minimize costs.

- Trading Platform: MT5, providing powerful charting tools and access to real-time market data.

The MT5 Pro account is particularly well-suited for traders who need a broad range of assets, value the advanced analytics of MT5, and want the flexibility to trade with higher leverage. This account type’s zero-commission feature is also advantageous for those who prefer lower trading fees.

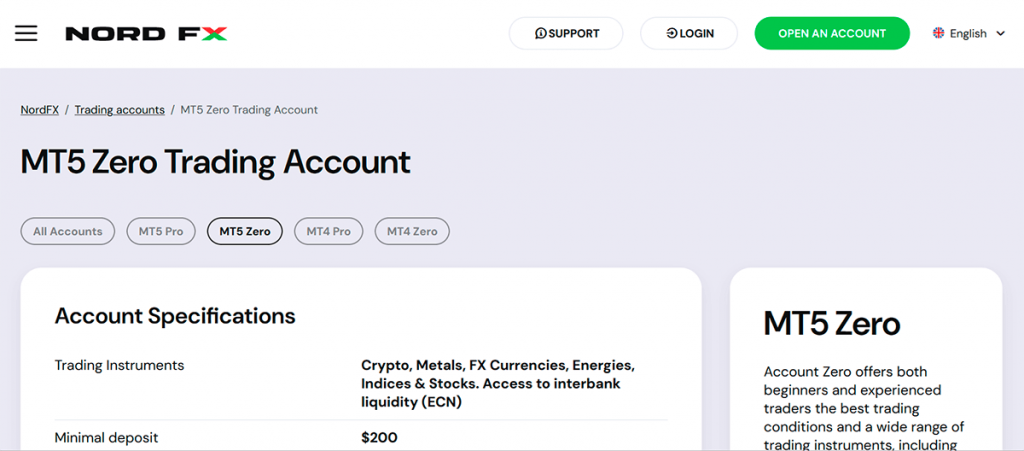

MT5 Zero Account

The MT5 Zero account is designed for traders who seek tighter spreads and access to interbank liquidity. Like the MT5 Pro, it operates on the MetaTrader 5 platform, but it is specifically tailored for traders who prioritize ultra-low spreads, even if it means paying a small commission per trade. This account is ideal for high-frequency traders or those who rely on precision timing and require minimal costs in terms of spreads.

Key highlights of the MT5 Zero account:

- Minimum Deposit: Higher than the MT5 Pro, catering to more serious or professional traders.

- Spread: Ultra-low spreads starting from 0 pips, providing direct access to interbank liquidity.

- Leverage: Up to 1:1000, enabling traders to scale their trading volume efficiently.

- Commission: A commission per trade side, which balances out the benefits of tight spreads.

- Trading Platform: MT5, allowing for robust analytics and advanced trading functionalities.

The MT5 Zero account is highly suitable for professional traders or those with a high trading frequency who are sensitive to spread costs. The low spreads, in combination with MT5’s powerful features, make it a compelling choice for traders with precision strategies.

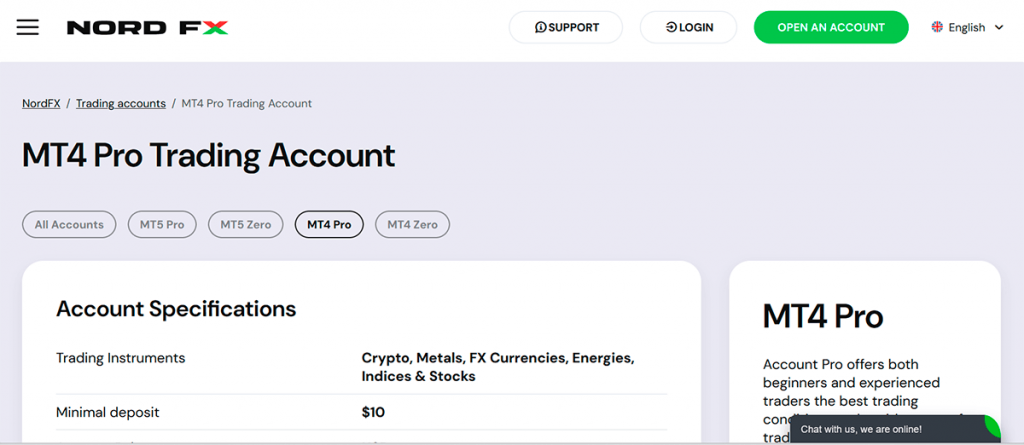

MT4 Pro Account

For those who prefer the simplicity and reliability of MetaTrader 4 (MT4), the MT4 Pro account offers an accessible and well-rounded trading environment. The MT4 platform remains one of the most popular trading platforms worldwide due to its intuitive design, user-friendly interface, and efficient execution of trades. The MT4 Pro account is perfect for traders who may be new to the market or prefer MT4’s straightforward functionalities.

Key highlights of the MT4 Pro account:

- Minimum Deposit: Reasonable, making it highly accessible for new traders.

- Spread: Competitive spreads that are well-suited for longer-term trades.

- Leverage: Up to 1:1000, offering flexibility for various trading styles.

- Commission: No commission on FX trading, which is beneficial for cost-conscious traders.

- Trading Platform: MT4, known for its ease of use and compatibility with automated trading systems.

The MT4 Pro account is a great option for traders who want to use MT4 and appreciate having competitive spreads without needing to pay commissions on forex trades. This account type appeals to traders who prioritize ease of use and effective trade execution.

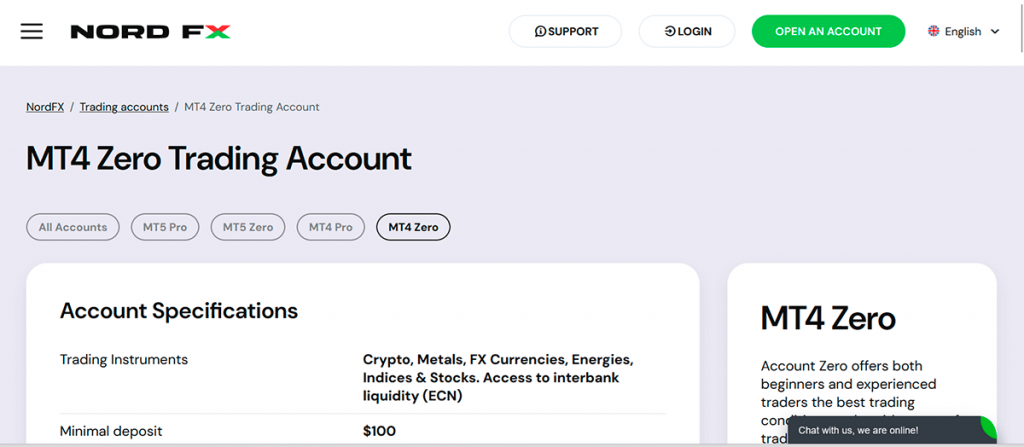

MT4 Zero Account

The MT4 Zero account combines the simplicity of MT4 with ultra-tight spreads and access to interbank liquidity. It offers an optimized environment for traders who prefer low spreads and can manage a small commission per trade. By providing access to zero spreads, this account type enables traders to make precise entries and exits, making it ideal for strategies where every pip counts.

Key highlights of the MT4 Zero account:

- Minimum Deposit: Higher than the MT4 Pro, tailored for experienced traders.

- Spread: Starting from 0 pips, ensuring minimal costs per trade.

- Leverage: Up to 1:1000, maximizing trading flexibility.

- Commission: Commission per trade side, offsetting the advantages of zero spreads.

- Trading Platform: MT4, suitable for both manual and automated trading.

The MT4 Zero account caters to traders who value access to interbank spreads while enjoying the simplicity of MT4. This account type is particularly advantageous for those who use high-frequency trading strategies or need low spreads for short-term trades.

Detailed Breakdown of Each Account Type

In this section of our NordFX account types review, we’ll provide a detailed analysis of each NordFX account type, focusing on essential features such as minimum deposits, spreads, leverage options, commissions, and supported trading instruments. This breakdown will offer insight into which account type might be the best fit for your trading preferences.

MT5 Pro

The MT5 Pro account is designed for traders who want access to advanced trading tools and a wide range of assets, making it ideal for those who seek a balanced trading experience with cost-effective spreads and zero commission on forex trades.

- Minimum Deposit Requirement: The MT5 Pro account requires a moderate initial deposit, making it accessible for both intermediate and advanced traders. This deposit level is optimal for traders who wish to access a comprehensive trading environment without a substantial upfront commitment.

- Spread Details and Leverage Options: This account offers competitive floating spreads, making it a suitable choice for traders who want lower trading costs. With leverage of up to 1:1000, traders can manage larger positions with minimal capital, a major benefit for those who seek to optimize their investment potential.

- No Commission on FX: One of the standout features of the MT5 Pro account is its zero-commission structure on forex trades. This is particularly appealing for high-frequency forex traders or those looking to minimize costs over the long term.

- Annual Free Margin Interest: Another advantage of this account type is the annual interest on free margin, adding value for traders who maintain unutilized funds in their account.

- Available Trading Instruments and Platform: Operating on the MetaTrader 5 platform, the MT5 Pro account provides access to forex, cryptocurrencies, CFDs on stocks, indices, and commodities. The MT5 platform itself is highly regarded for its expanded analytical tools and flexible charting options, making it an excellent choice for traders who value in-depth market analysis.

The MT5 Pro account is a balanced option that combines low-cost trading, high leverage, and a wide array of instruments, making it ideal for traders with moderate to advanced experience.

MT5 Zero

The MT5 Zero account is tailored for traders who seek direct access to interbank liquidity with minimal spreads, particularly suitable for those focused on high-frequency or large-volume trades.

- Minimum Deposit Requirement: The minimum deposit for the MT5 Zero account is higher than the MT5 Pro, positioning it as an account type for more serious traders who are comfortable with a greater initial investment.

- ECN Access and Ultra-Low Spreads: Through the MT5 Zero account, traders have ECN (Electronic Communication Network) access, offering ultra-low spreads starting from 0 pips. This feature provides users with precise market pricing, essential for strategies where every pip matters.

- Commission per Trade Side: To balance the benefit of zero spreads, a commission is charged per trade side. This commission structure is attractive for traders who prefer paying for liquidity access and low spreads over wider spreads and zero commission.

- Interest on Free Margin: Similar to the MT5 Pro account, the MT5 Zero also offers interest on free margin, giving traders an incentive to maintain funds in their accounts.

- Supported Assets and Platform: Operating on the MT5 platform, this account type supports trading in forex, cryptocurrencies, CFDs on stocks, commodities, and indices, allowing for extensive diversification. The MT5 platform’s cutting-edge features enable users to make the most of this advanced account type.

The MT5 Zero account is suited for professional traders or those with high trading frequency who prioritize minimal spreads and are comfortable with a commission-based fee structure.

MT4 Pro

The MT4 Pro account is ideal for traders who prefer the MetaTrader 4 (MT4) platform, a trusted and user-friendly environment known for its stability and compatibility with various trading strategies.

- Minimum Deposit and Spread Specifics: The MT4 Pro account offers a relatively low minimum deposit, making it highly accessible to both beginners and experienced traders. It features competitive spreads, which contribute to cost-effective trading without the need for a significant upfront investment.

- Leverage Benefits and Commission-Free FX Trading: With leverage up to 1:1000, the MT4 Pro account provides ample trading power, enabling traders to maximize their potential returns on smaller deposits. Additionally, forex trades incur no commission, making it attractive for traders focused on minimizing fees.

- Asset Classes and Platform Features: The MT4 Pro account allows access to forex, cryptocurrencies, commodities, and indices. MT4, with its robust yet straightforward interface, is popular among traders for its reliability and compatibility with automated trading systems. This platform is particularly well-suited for traders who prefer manual or algorithmic trading strategies.

The MT4 Pro account offers a cost-effective entry point with high leverage and zero-commission forex trading, making it an excellent choice for traders who value ease of use and minimal trading costs.

MT4 Zero

The MT4 Zero account offers the best of both worlds: the simplicity and popularity of the MT4 platform with the benefits of interbank liquidity and ultra-tight spreads. This account type is ideal for precision-focused traders who need low-cost access to the market.

- Minimum Deposit and Interbank Liquidity Access: With a higher minimum deposit than the MT4 Pro account, the MT4 Zero account is tailored for more experienced traders or those with a preference for trading in a high-precision environment. The interbank liquidity access ensures competitive spreads starting from 0 pips.

- Zero Spreads with Trade Commission: While the spreads start at zero, there is a small commission per trade side. This fee structure is attractive for traders who prioritize narrow spreads over a no-commission model, especially beneficial for those employing scalping or short-term trading strategies.

- Trading Instruments and Platform Overview: Like other NordFX accounts, the MT4 Zero account offers access to a diverse range of assets, including forex, cryptocurrencies, commodities, and indices. The MT4 platform’s intuitive interface and automated trading compatibility make it a strong choice for those who prioritize both user-friendliness and functionality.

The MT4 Zero account is especially suitable for traders who value MT4’s simplicity but require access to tight spreads and precise pricing. It’s a favored choice for scalpers and short-term traders who benefit from low spread costs and are comfortable with a small commission.

Summing Up the Detailed Breakdown of NordFX Account Types Review

This NordFX account types review highlights how each account—MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero—has unique features that cater to specific trading needs and preferences. Whether you’re drawn to MT5’s advanced tools or MT4’s simplicity, NordFX ensures that traders have options that align with their goals and trading strategies. In the following sections, we’ll provide more guidance on how to select the account type best suited to your individual trading style.

Comparative Analysis of Account Features

In this part of the NordFX account types review, we’ll compare the core features across the MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero accounts. By analyzing the spreads, commissions, leverage, and platform differences, traders can better understand how each account type aligns with their trading preferences and cost considerations. If you want a complete NordFX Review (In-Depth Look at the Broker), please check this link – https://nordfx.wiki/nordfx_review/

Spreads and Commissions

A key aspect of any trading account is the cost structure, including spreads and commissions. NordFX has strategically structured its account options to suit various trading styles and levels of frequency.

- MT5 Pro: This account offers competitive floating spreads, which remain cost-effective without incurring commission fees on forex trades. Traders who prioritize low spreads and seek a zero-commission model may find MT5 Pro a well-balanced option.

- MT5 Zero: The MT5 Zero account provides ultra-low spreads, starting from 0 pips, making it highly attractive to those who prioritize tight spreads. However, a commission is applied per trade side, which offsets the spread advantage. This commission structure makes MT5 Zero an ideal choice for traders focused on high-frequency strategies, where every pip of spread cost matters.

- MT4 Pro: Like the MT5 Pro, the MT4 Pro account offers competitive spreads and includes a zero-commission policy on forex trades. This structure is optimal for traders who may not need the ultra-tight spreads offered by MT5 Zero but still appreciate cost-effective trading.

- MT4 Zero: The MT4 Zero account provides access to interbank liquidity, offering spreads that start from 0 pips. Similar to the MT5 Zero account, a commission per trade side is charged, which appeals to traders who need low spreads for precise trading strategies, especially short-term trades.

Overall, NordFX’s accounts cater to a range of preferences: the Pro accounts (MT5 Pro and MT4 Pro) appeal to those looking for cost-effective spreads without commissions on forex trades, while the Zero accounts (MT5 Zero and MT4 Zero) cater to those who prioritize minimal spreads and are comfortable with a commission structure.

| Account Type | Minimum Deposit | Spread | Leverage | Commission | Free Margin Interest | Platform | Ideal for |

| MT5 Pro | Moderate | Floating, competitive | Up to 1:1000 | None on FX | Annual interest | MT5 | Traders seeking low-cost trading and advanced tools |

| MT5 Zero | Higher | Ultra-low, starting from 0 pips | Up to 1:1000 | Commission per trade side | Annual interest | MT5 | Professional and high-frequency traders who prioritize tight spreads |

| MT4 Pro | Low | Competitive | Up to 1:1000 | None on FX | None | MT4 | Traders who prefer simplicity and low costs |

| MT4 Zero | Higher | Starting from 0 pips | Up to 1:1000 | Commission per trade side | None | MT4 | Traders needing low spreads and precise market access |

Leverage Options

Leverage is a powerful tool for traders, allowing them to control larger positions with a relatively small amount of capital. NordFX provides leverage up to 1:1000 across all account types, giving traders significant flexibility in their trading strategies.

- High Leverage: The leverage of up to 1:1000 across all NordFX account types allows traders to control large positions, potentially amplifying both profits and losses. This high leverage is advantageous for traders who have effective risk management strategies and are looking to increase their exposure to the market without a substantial capital outlay.

- Flexible Leverage Usage: While high leverage is available, traders also have the option to adjust their leverage to suit their individual risk tolerance. For beginners or those trading with smaller amounts, lower leverage might be more suitable, while experienced traders may choose higher leverage to maximize position sizes.

This standardized leverage across NordFX’s account types means traders can choose an account type based on spreads, commissions, and platform preferences without compromising on leverage.

Trading Platforms: MT4 vs. MT5

NordFX offers accounts based on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both highly regarded trading platforms that cater to different user needs. Understanding the differences between MT4 and MT5 can help traders determine which platform and corresponding account type is best suited for their strategies.

- MetaTrader 4 (MT4): Known for its simplicity and reliability, MT4 has been a staple in the trading industry for over a decade. It is a favored choice among traders for its ease of use, making it especially attractive to beginners or those who prioritize straightforward functionality. Key features include:

- User-friendly interface and customizable charts

- Compatibility with Expert Advisors (EAs) for automated trading

- Support for forex, commodities, indices, and cryptocurrency CFDs

The MT4 Pro and MT4 Zero accounts are ideal for traders who prefer the tried-and-tested MT4 platform, which is also known for its low resource usage and compatibility with numerous automated trading systems.

- MetaTrader 5 (MT5): MT5 is the next-generation platform developed by MetaQuotes, offering more advanced tools and asset classes. While it maintains some of MT4’s core features, MT5 is better suited for professional traders who need more detailed analysis and multi-asset access. Key features include:

- Expanded charting tools and technical indicators

- Multi-threaded back-testing for more efficient strategy testing

- A greater variety of timeframes and order types

- Support for trading a broader range of assets, including stocks and additional CFDs

The MT5 Pro and MT5 Zero accounts are best suited for traders who require more advanced analytical tools, more diversified assets, and improved performance for automated trading.

Overall, MT4 is known for its simplicity and efficiency, ideal for forex traders and beginners. MT5 offers more complex tools and asset options, making it a popular choice among professionals and those trading across multiple asset classes. By offering both platforms, NordFX ensures traders have the flexibility to choose based on their platform preference and trading requirements.

Summary of Comparative Analysis

This NordFX account types review highlights the diverse and competitive features available across MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero accounts. NordFX accommodates traders with varied preferences through cost-effective spreads, flexible leverage, and the choice between MT4 and MT5 platforms. Whether you’re seeking minimal spreads, no-commission forex trades, or advanced platform functionalities, NordFX’s range of account types provides tailored options for every trading style and strategy.

Choosing the Right NordFX Account

Selecting the right account type is essential to aligning your trading approach with your financial goals, experience level, and preferred asset classes. In this NordFX account types review, we’ll guide you through considerations for choosing the best-suited account type based on your trading style, available capital, and the assets you want to trade. NordFX offers a range of accounts tailored to meet different needs, from beginners to advanced traders, ensuring you can optimize your trading environment for success.

Factors to Consider When Choosing a NordFX Account

When deciding which NordFX account type is best for you, it’s essential to factor in your trading experience, budget, and preferred trading instruments. Here’s a breakdown by NordFX account types review of the most important considerations to help you make an informed choice.

- Trading Experience

- Beginners: For those new to trading, accounts like the MT4 Pro are often a good fit. The MetaTrader 4 (MT4) platform is known for its simplicity and ease of use, making it a preferred choice for beginners. The MT4 Pro account offers competitive spreads, no commissions on forex, and access to a straightforward platform that can help you learn the basics of trading without being overwhelmed by complex features.

- Intermediate and Experienced Traders: For those with a bit more experience, the MT5 Pro account is a strong option, especially if you want to access more advanced trading tools on MetaTrader 5 (MT5). MT5 offers expanded timeframes, order types, and advanced charting capabilities. This account is ideal if you’re comfortable with technical analysis and want to trade a wider variety of assets with cost-effective conditions.

- Professional and High-Frequency Traders: If you’re a professional trader or use strategies that require tight spreads and quick execution, MT5 Zero or MT4 Zero may be the most suitable choices. These accounts provide ultra-low spreads starting from 0 pips, which is highly beneficial for high-frequency and scalping strategies. Although there’s a small commission per trade, the low spread structure can optimize your profitability on strategies that require precise entry and exit points.

- Available Capital

- Low to Moderate Capital: If you’re trading with a smaller capital base, the MT4 Pro or MT5 Pro accounts are ideal starting points. These accounts have more accessible minimum deposit requirements, allowing you to open positions without a significant upfront investment. Both accounts also offer up to 1:1000 leverage, which can be advantageous if you want to maximize your trading exposure while managing a limited capital.

- Higher Capital Investment: Traders with a larger capital base may consider the MT5 Zero or MT4 Zero accounts. These accounts require a higher minimum deposit but provide interbank liquidity and ultra-low spreads, making them suitable for high-net-worth or professional traders who prioritize minimal trading costs and are comfortable with a commission structure.

- Preferred Asset Classes

- Forex and Commodities: If you plan to trade primarily in forex and commodities, MT4 Pro and MT5 Pro are well-suited options. These accounts provide access to a broad range of forex pairs and commodities with favorable spreads and no commissions on forex trades, allowing for cost-effective trading in these markets.

- Stocks, Indices, and Cryptocurrencies: If you want to trade a more diverse portfolio, including CFDs on stocks, indices, and cryptocurrencies, MT5 Pro and MT5 Zero are recommended. The MT5 platform supports more asset classes than MT4, making these accounts suitable for traders who want diversified exposure and access to advanced analytical tools for broader markets.

- Precision Trading: For traders who require the precision of ultra-low spreads, especially when trading high-volatility assets like cryptocurrencies, MT5 Zero and MT4 Zero provide the tight spreads necessary for such strategies. These accounts give you the advantage of accessing narrow spreads, which can help optimize profitability on assets that demand high trading accuracy.

Tailoring Your Account Choice to Your Strategy

To summarize, the choice of the right NordFX account type depends on aligning your account selection with your trading goals and requirements:

- Choose MT4 Pro if you’re a beginner or a cost-conscious trader seeking simplicity and competitive spreads with no forex commissions.

- Choose MT5 Pro if you’re an intermediate or experienced trader wanting to trade multiple assets on an advanced platform without forex commission costs.

- Choose MT5 Zero if you’re a professional or high-frequency trader prioritizing tight spreads and access to diverse markets with the advanced MT5 platform.

- Choose MT4 Zero if you prefer the simplicity of MT4 but need interbank-level liquidity and ultra-low spreads for precision trading.

In this NordFX account types review, these guidelines can help you make the right choice based on your capital, asset preferences, and experience level. By selecting an account type that aligns with your goals, you’re setting up a foundation for effective trading tailored to your unique strategy and needs.

Why Choosing the Right Account Type Matters

Choosing the right account type is often underestimated, especially by newer traders. However, the account type you select can significantly impact your trading performance, from how much you pay in spreads and commissions to the leverage levels available and the types of assets you can access. Different traders prioritize different aspects, such as low spreads, high leverage, or access to specific markets. Therefore, understanding the distinct characteristics of each NordFX account type is essential to making an informed choice that matches your trading style and goals.

For example, an active day trader may prioritize an account type with tight spreads and minimal fees, whereas a long-term investor might value the stability and options that come with accounts offering more substantial spreads or specific asset classes. With NordFX’s range of accounts, traders can choose an account that aligns with their preferences, whether that’s ultra-low spreads for high-frequency trading or a platform designed for access to interbank liquidity. This flexibility allows users to shape their trading environment in a way that best supports their strategies.

The Advantages of Trading with NordFX

NordFX stands out among brokers by offering a unique combination of industry-leading technology, user-friendly platforms, and advantageous account conditions. Through its MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, NordFX provides seamless access to advanced charting tools, one-click trading, and automated trading options, which empower traders to execute their strategies efficiently. Furthermore, each NordFX account type is designed to maximize these platform features, offering clients the tools needed to succeed, regardless of their trading background.

A standout benefit of trading with NordFX is its emphasis on affordability and accessibility, particularly in terms of deposit requirements and spreads. NordFX provides competitive pricing that allows traders to retain more of their profits, a factor that can make a substantial difference in long-term returns. For traders who are just starting, NordFX’s account types offer a low barrier to entry without sacrificing access to powerful trading tools and resources, making it possible for them to begin trading confidently with minimal risk.

Opening a NordFX Account

Embarking on your trading journey with NordFX is a straightforward process, designed to accommodate both new and experienced traders. Here’s a step-by-step guide to help you open a live trading account and access demo accounts for practice.

Steps to Open a Live Trading Account

- Visit the NordFX Website: Navigate to the official NordFX website at https://nordfx.com/.

- Initiate the Registration Process: Click on the “Open an Account” button, typically located at the top right corner of the homepage.

- Complete the Registration Form: Fill in the required personal information, including your full name, email address, phone number, and country of residence.

- Verify Your Identity: To comply with regulatory standards, you’ll need to provide identification documents, such as a passport or driver’s license, and proof of address, like a utility bill or bank statement.

- Select Your Account Type: Choose the account type that aligns with your trading goals—options include MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero.

- Fund Your Account: After your account is approved, deposit funds using your preferred method. NordFX supports various deposit options, including bank transfers, credit/debit cards, and e-wallets.

- Download the Trading Platform: Depending on your chosen account type, download the appropriate trading platform—MetaTrader 4 (MT4) or MetaTrader 5 (MT5)—from the NordFX website.

- Start Trading: Log in to the trading platform using your account credentials and begin trading across a wide range of financial instruments.

Accessing a Demo Account for Practice

For those new to trading or looking to test strategies without financial risk, NordFX offers free demo accounts. Here’s how to set one up:

- Download the Trading Platform: Visit the NordFX website and download the MT4 or MT5 platform, depending on your preference.

- Install and Launch the Platform: After installation, open the platform on your device.

- Create a Demo Account: Upon launching the platform, you’ll be prompted to create an account. Select “Open a Demo Account,” fill in the necessary details, and choose your desired account parameters, such as leverage and initial virtual balance.

- Receive Login Credentials: After registration, you’ll receive your demo account login and password. Use these credentials to access the demo environment.

- Start Practicing: With your demo account set up, you can practice trading in real market conditions without risking real money.

Demo accounts are free of charge and have no expiration date. However, if a demo account remains inactive for over 14 days, it will be deleted.

By following these steps, you can seamlessly open a live or demo account with NordFX, providing a solid foundation to pursue your trading objectives. This NordFX account types review is also very helpful.

Frequently Asked Questions (FAQ)

1. What types of accounts does NordFX offer?

NordFX provides four main account types: MT5 Pro, MT5 Zero, MT4 Pro, and MT4 Zero. Each account type is designed to meet different trading needs, from beginner-friendly options to professional-grade accounts.

2. Which NordFX account type is best for beginners?

For beginners, the MT4 Pro account is often a suitable choice due to its ease of use and competitive spreads with no commission on forex trades. The MetaTrader 4 (MT4) platform is intuitive, making it ideal for those new to trading.

3. What is the minimum deposit for NordFX accounts?

The minimum deposit varies by account type. The MT4 Pro account has a lower minimum deposit requirement ($10), making it accessible for traders with smaller budgets. In contrast, MT5 Zero and MT4 Zero accounts have higher minimum deposits, designed for more experienced traders.

4. Are there any commission fees on NordFX accounts?

MT5 Pro and MT4 Pro accounts do not have commission fees on forex trades, which makes them appealing for those who prefer zero-commission trading. MT5 Zero and MT4 Zero accounts offer ultra-low spreads starting from 0 pips, but a commission per trade side is charged.

5. What is the maximum leverage offered by NordFX?

All NordFX account types offer up to 1:1000 leverage, allowing traders to manage larger positions with a relatively small amount of capital.

6. What is the difference between the MT4 and MT5 platforms?

MT4 is simpler and widely preferred by forex traders for its ease of use and compatibility with automated strategies. MT5 offers advanced tools, additional timeframes, and supports a broader range of assets, making it suitable for traders who need in-depth analysis and more diverse trading options.

7. How do I choose the best NordFX account type for my needs?

Consider factors like your trading experience, budget, and asset preferences. MT4 Pro is ideal for beginners; MT5 Pro suits traders who want advanced tools without commissions on forex; MT5 Zero and MT4 Zero are suitable for professionals needing ultra-low spreads.

8. Can I open a demo account with NordFX?

Yes, NordFX offers free demo accounts for both MT4 and MT5 platforms. Demo accounts allow you to practice trading in real market conditions without risking real money, making them perfect for testing strategies.

9. How do I open a live trading account with NordFX?

To open a live account, visit the NordFX website, fill out the registration form, verify your identity, select an account type, and fund the account. You’ll then be able to download the MT4 or MT5 platform and start trading.

10. What assets can I trade on NordFX?

NordFX offers a wide range of financial instruments, including forex, cryptocurrencies, commodities, indices, and CFDs on stocks. The choice of assets may vary depending on your selected account type and platform (MT4 or MT5).

Summing Up the NordFX Account Types Review

With a range of options from the MT5 Pro and MT5 Zero accounts to the MT4 Pro and MT4 Zero accounts, NordFX has structured its account offerings to cover all trading preferences and styles. Whether you’re looking for a platform with no commissions, ultra-tight spreads, or access to a variety of assets, each NordFX account type offers a unique set of advantages that can meet specific trading needs.

This NordFX account types review provides a comprehensive outline of the choices available, giving traders the information they need to select an account type that aligns perfectly with their goals and trading strategies.

Previously they had only MT4, now they offer account on MT5 too. Good, will try MT5 Zero Account, as I don’t want any spreads.

Awesome review, thanks bro! There are plenty black PR sites like wikifx, who post fake info about brokers and then blackmail brokers for money. So, it’s hard to find a true review about the broker these days.

I started with their zero account because my trading strategy requires 0 spreads.

I don’t use zero account, don’t understand how the comission work. For me it is better to pay spread and forget about it. Their MT5 Pro is good, just $50 deposit and you can use the web terminal and trade anywhere you want. I don’t like the app.